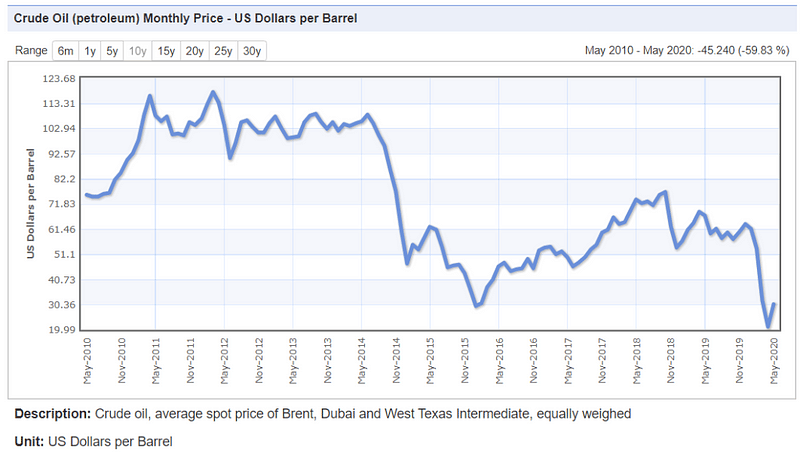

I have seen many posts where people praise the current government for lower fuel prices without understanding that though the absolute price of the fuel is gone down, they are effectively paying way more than the standards of 2013. In 2013, when the crude prices were hovering above US$100 the petrol prices in India were around ₹83 a litre, whereas now when the crude oil price is less than US$65 for the majority of the last 2 years we are paying around ₹75 a liter for petrol.

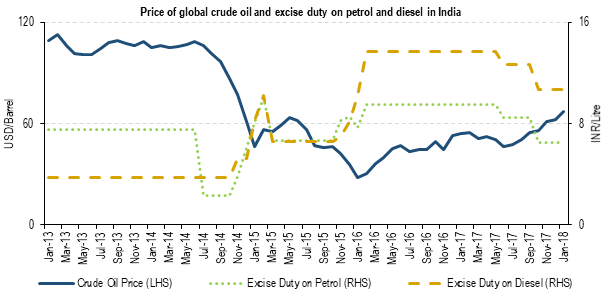

The Government of India has used the reducing price of crude oil as an opportunity to raise its revenue by pocketing the majority of the reduction in price by increasing its taxes on the fuel. It’s further evident by comparing the crude prices to the excise duty on petrol & diesel prices.

If we look at the data, the excise duty on petrol was ₹9.48 per litre, while that on diesel was ₹3.56 per litre in May 2014, whereas currently is ₹32.98 per litre on petrol and ₹31.83 per liter on diesel. If we look at the current prices, the government is collecting around 270% taxes on the base price of petrol and 256% taxes on the base price of diesel [3].

However, getting more taxes is not the only reason for the government to increase the taxes, the government also wants to stabilize the price of petrol and diesel over the long run as it brings predictability in the businesses and the logistical expenses, letting the prices fluctuate with the crude oil prices will make the logistical expenses way more unpredictable and will have negative consequences on the businesses. I do agree with this logic, but then, I think the crude oil prices have been below US$65 for a long time and the government must reduce the prices to something around ₹50-₹55 a litre which will provide enough room for the government to stabilize the prices in the normal course yet passing on a significant portion of the benefit to the consumer. This will also help in reducing the logistical costs as in India the logistics cost consists of 14% of the total value of the goods[4] and fuel prices contribute to around 50% of the logistical cost and it’s a known fact that the prices of fuel have a positive correlation with the prices of grocery items.

One might say that maintaining high fuel prices keeps the fuel consumption in check, but then if we look in India the car penetration is significantly low at 22 cars per 1000 individuals [5] and we have a huge opportunity waiting for us only if we can reduce the fuel prices, considering the automobile manufacturing contributes to 49% of manufacturing GDP and 7% of the overall GDP of the country on 2019[6]. Reducing the fuel prices in the current scenario will provide a boost to the automobile sector and if thoughtfully done will make up for the loss in excise duty by bringing in GST from the automobile sales and higher consumption of fuel.

Now if look at the taxation part, the government has significantly increased its revenue from the excise duty on fuel prices and have made close to ₹1.42 trillion [7], however, increased revenue from excise has not helped the government that much as we can argue that the government has increased it’s the reliance on the excise duty over the years and have increased the excise duty to fill in the gaps in tax collection from other sources.

I do understand that the government has to raise money, but I have a feeling that they have found an easier way out with the excise duties. I also agree that maintaining the fuel prices has its own benefits, but I think, the crude oil prices have not been that volatile in the last couple of years and the government is playing smart to pass on very little to the consumer to keep the prices lower than the previous government so that they can claim it as a victory in front of ignorant masses while clearly knowing that the informed mass can’t do much about it.

Special Mention: My friend Rahul Sharma, who was a resident expert on the oil industry at IIMA and helped me to understand this industry.

References

[1] Index Mundi

[3] The Wire

[4] Sustainable Operations in India, Chakraborty, Ayon, Kumar Gouda, Sirish, Gajanand, M. S.

Originally published at https://www.rahulrajsharma.com on August 26, 2020.