This blog post is a work of three authors, Deapak Kumar Jha, Rahul Raj Sharma, and Vicky Vasudev Sindhi

The Make in India initiative was launched by the then Prime Minister of India Mr. Narendra Damodardas Modi, on the 25th of September 2014. This initiative was part of the wider set of policies to help the Indian economy and raise the contribution of manufacturing in the country’s GDP to 25% by 2025. Make in India was expected to grow the MSME sector, increase jobs and exports, and reduce imports by replacing the imported goods by internally produce substitutes.

In order to support the Make in India initiative, the Government of India announced multiple other schemes to compliment it, which could have helped the Make in India initiative had they got some traction. Some of such initiatives are as follows:

In this article, we will try to analyze the various factors and see what went well and what went wrong in the implementation of the Make in India initiative and what the Government of India could have done better to achieve the intended results from this initiative.

Need for “Make in India” Policy

After the economic reforms of 1991, the Indian economy has grown at decent rates, and in fact, during 2003–2011 period it grew on average above 8%. Despite such a high growth rate, only 5.1 million new jobs were created during 2004–12. Also, the growth rate faltered after 2012 and there was a need to increase manufacturing share in India’s GDP, which is fairly constant at 16% since 1991.

History tells us that all developed economies first developed their agriculture, then excelled in manufacturing and only then transitioned to the service-led economy. Whereas when we look in India, manufacturing never picked up and after 1991, growth is mostly led by services. However, even for sustained growth in the services industry, a vibrant manufacturing sector is warranted and it is also required to support the employment of the burgeoning population of India.

Understanding the need of the hour, the Modi government announced Make in India policy to increase manufacturing share in the GDP. However, to have any meaningful impact, the government will have to do more than sloganeering and publicity initiatives and bring a comprehensive and coordinated industrial policy. All the successful East Asian countries have not only followed the export-Led growth model, but they also adopted carefully planned coordinated industrial policy. Industrial policy from the state is necessary for a country like India and if left to market forces, it can also go “Latin American” way.

Some people argue that in an open economy government should leave it to market forces and they cite IT industry as an example, which has done exceedingly well with little support. However, they forget that even in IT industry’s growth government policies have played a major role. First, the government invested in creating high-speed Internet connectivity of global standards with the USA for the IT software parks. Second, the government then brought trade-in services into the regulatory framework of imports and exports, allowing the IT industry to import duty-free both hardware and software. Third, the IT industry was able to function under the Shops and Establishment Act, hence not subject to the laws relating to labor and the onerous regulatory burden these impose. Finally, the IT sector had the benefit of low-cost, high-value human capital in scientific and technical education. These offer insights into the potential for industrial policy [2].

The success of Make in India policy depends mainly on the success of four pillars [3]:

Targets of Make in India

The Make in India initiative was trying to achieve the following targets:

Decrease Imports: This scheme was trying to fulfill internal consumption by reducing imports and supplying internal demands through Indian manufacturers.

Increase Exports: Through the Make in India, the Government of India wanted to replicate Chinese policies to make India a global hub in manufacturing. While introducing this scheme Prime Minister of India Mr. Modi said “I want to tell the people of the whole world: Come, make in India. Come and manufacture in India. Go and sell in any country of the world but manufacture here. We have the skill, talent, discipline and the desire to do something. We want to give the world an opportunity that come make in India [10].”

Increase Employment: Make in India is expected to increase employment by providing them jobs in the manufacturing industry. This could have generated a huge opportunity for semi-skilled workers had the government was able to make it work.

Technological Reliance: One of the key objectives of Make in India was to produce indigenous technology to reduce reliance on imported technology and this objective was realized in a way by pushing Make in India in defense manufacturing and by providing contracts to Indian manufacturers for multiple defense requirements.

Increase the contribution of manufacturing: The government of India was aiming to increase the contribution of the manufacturing sector to 25% from 16% in 2014 by providing the required stimulus through the Make in India scheme.

Analysis of the impact of Make in India

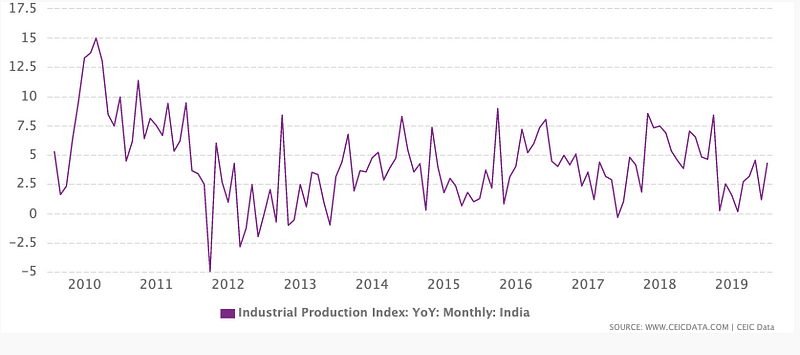

When we look at the data, we don’t see any impact of Make in India on IIP index growth rate.

From the manufacturing value-added share of GDP data, we find that its share only reduced from 2014 to 2018.(a positive blip seen only in 2015).

Data on MSME ministry website is updated only till 2015–16 and no conclusion can be made from this data.

“Make in India” or “Made for India” or “Assemble in India”

Export-led growth has been a proven model for all industrialized East Asian countries and probably through Make in India policy government wants to replicate the same model. However, noted economist Raghuram Rajan argues that under the present geopolitical and trade situations it is extremely difficult to replicate the same model [3]. First, almost all industrialized economies are growing very slow and trying to adopt protectionist measures. Second, with dynamic change in technology, the weightage of labor components in manufacturing is coming down and probably developed nations may try to bring back manufacturing back to onshore. Third, China is still competitive and it is very hard for a large economy like India to create a space for itself. He argues that India should focus on the Indian market mostly without falling in the trap of import substitution attempts.

In the 2020 economic survey, CEA argues in favor of “Assemble in India” replicating again the Chinese model. He argues that despite low-value addition in China for thousands of items, the aggregate value becomes quite high and if India like China becomes part of the global value chain (GVC), it can bring huge employment opportunities for low skilled laborers. He further argues that “The experience of countries that have achieved rapid and sustained export growth suggests that India can reap rich dividends by adopting policies aimed at strengthening its involvement in the export market for network products (NP). Given our vast manpower with relatively low skill, India’s current strength lies primarily in the assembly of NP” [14].

Inverted Duty Structure and Free Trade Agreements

In India, the simple average tariff fell from 126% in 1990–1991 to 36% in 1997–1998 and then to 12.1% in 2014–2015[2]. Tariffs were reduced to well below the upper bound of rates permissible under WTO rules. Also, India signed free trade agreements with the country and country blocks such as Korea, ASEAN, Japan etc., these FTA only worsened the situation for Indian manufacturing.

Moreover, one thing that is hurting the Indian manufacturing industry is the inverted duty structure. When a higher duty on intermediate goods is levied compared to final/finished goods, with the latter often enjoying concessional custom duty under some schemes, it is called inverted duty structure. Unfortunately, many of the Indian industries are facing an inverted duty structure. Some notable examples are IT and mobile, chemical, paper, machinery, and equipment etc. [2].

The one sector studied that did not face an IDS prospered in India was automobiles. In this sector, most final goods are under the negative list of imports; components are not. Most-favoured-nation tariff rates were high for importing vehicles in completely built-up form. However, duties are quite low for the completely knocked down version which promoted local assembling of vehicles. Not surprisingly, India became one of the largest manufacturers of motor vehicles in the world-two-wheelers, three-wheelers, cars, trucks, and buses [2].

Cluster Development for MSMEs

Before economic liberalization, many of the manufacturing goods categories (as large as 500 till 2005) were reserved only for MSMEs. This reservation policy hindered them to get even a minimum economy of scale and made them uncompetitive. Also, the withdrawal of incentives when firms got scales encouraged firms to stay small. When tariffs were brought down especially after the 2000s, it was extremely difficult for these small-scale units to compete with economies of scale of East Asia. Small scale, rigid labor laws, bad infra, high electricity, and logistics cost, negative protection from tariffs, high cost of doing business — all these factors make our MSMEs uncompetitive. To overcome these problems, a cluster development approach could be adopted.

Currently, all cluster programs are administered by several ministries [textiles, leather, food, MSME, heavy industry (auto)] under various names and different terms and conditions. This fragmentation of policy must end. Serious planning for clusters across the country requires industrial planning, both at the federal level and at the state level. There are 1400 modern industry clusters in India spread throughout the country, but cluster development could be facilitated because they constitute a geographically concentrated set of activities. In addition, there are nearly 4500 traditional activity clusters producing artisanal products (handloom, handicraft, and other traditional single-product group clusters) using old technologies, characterized by low productivity and low earnings, with a large number of self-employed or own-account workers. Most of India’s unorganized manufacturing, which accounts for 40% of manufacturing GDP and over 50% of exports, is located in these clusters [15].

Cluster development seems to be a way forward for the development of MSMEs. With coordinated cluster policy, something similar to SEZ policy, MSMEs productivity levels can be increased hugely. It can also be a panacea for solving India’s unemployment problem, at least partially.

After the clustering approach, there are other issues that need attention. First, allowing intra-cluster trade with minimum transaction costs. Levying of GST on such transactions negates the whole purpose. All such transactions should be at minimum possible transaction costs [16]. Second, favorable credit policy for them especially for micro and small enterprises. It seems, small and micro firms crowded out from priority lending funds and struggle for working capital issues. Third, skill development around clusters, especially in consultation with entrepreneurs.

In the digital and marketing age, and with the presence of giant MNCs government should form a cluster/product category-specific marketing and trading channel, preferably through the digital medium. Transaction cost for a small exporting firm is formidable, so a cluster level unit (maybe on PPP model) can represent the cluster. Moreover, even R&D and product development jobs can be done at the cluster or cluster of clusters level. A government-backed trading platform (like Amazon, Flipkart) can also reduce the transaction cost for small firms.

The government should also do away with the policy that “small is beautiful”. MSMEs don’t need to remain small for always and must be encouraged to grow bigger.

The development of industrial corridors is a part of the area or cross-state planning process. India was largely by-passed by the trade-in networked products (NPs), where it exports only $25 billion (0.5% of global trade in NPs).

Like in automobiles, India could become a preferred destination for assembly of electronics, telecom hardware, electrical machinery, computers, and office machines, if it makes a strategic plan (like the Automotive Mission Plan 2006–2016) to increase its exports [15]. The same sentiment has echoed in India’s economic survey by CEA.

R&D, Design and creating an innovation culture

India has many strengths in R&D, but it still lacks the key ingredients of a national innovation system. India’s well-developed R&D infrastructure is the key to success as a leading offshore research location. However, government R&D has largely focused on defense and space, which cornered 26% and 18% of Central Government R&D, respectively [15].

Major challenges remain in India’s incipient national innovation system. The creation of a ‘Learning Society’ needs some extensions in India- to ensure ‘learning by doing’. Three such extensions are needed. First, manufacturing capacity must increase across the board in many sectors beyond automobiles and pharma. However, the absence of an industrial policy has prevented India from becoming a manufacturing hub, leaving innovation stunted and total factor productivity lower than its potential. The second challenge is that multiple failures in the entire education system have led to poor educational outcomes for the current workforce. The third challenge is an underfunded R&D system that has no way to convert patents into commercially viable technological solutions [15].

India allocates only 0.7% of GDP to R&D, while China invests 1.8%, the USA 2.9%, and Japan 3.4%. India currently underspends even relative to its income level. In addition, most other countries, especially East Asian countries like China, Japan, and Korea, have seen dramatic increases in R&D as a percentage of GDP as they have become richer. India, on the other hand, has seen only a slight increase (Ministry of Finance 2018, Economic Survey).

To become an innovative society government will have to focus on:

Labor reforms

One reason organized manufacturing jobs have not grown is the plethora of central labor laws (47 reduced to 35 through repeal over the 2014–18) that apply, in addition to over 100 state government labor-related laws. There is a very strong case for simplification and rationalization of at least central laws into four labor codes. The government has been aware of this reality and recently it introduced the “labor code on industrial relations” bill in the parliament. This new labor code will amalgamate the existing plethora into 4 codes: on wages, industrial relation, social security and safety, and health and working condition [17].

Macroeconomic policy, Tariff and Exchange Rate

Small enterprises can play a major role in export-led manufacturing growth because of their access to unorganized labor, finds an IIMA study based on data from 1200 small scale firms, provided favorable exchange rate policy [18]. Import substitution and push to exports can go hand by hand if carefully planned, a key component of East Asian strategy. The need of the hour is to come out of orthodoxy and set a dis-equilibrium exchange rate. The real exchange rate between 2014–18 has appreciated by 20% which destroys any competitive advantage [15]. The government must set its focus on the real exchange rate and devalue Rupee to get a competitive advantage back [19]. Also, frequent tinkering in tariff without any long-term strategy has not done any good to the country. The government should first have a strategy to nurture the industry, capability building, and then tariff protection for some time will give the industrial economy of scale. Only after getting some scale in the country, firms can compete globally. The success of Automobile, IT, and pharma sector validate that given the right policy framework and environment, Indian firms can compete globally.

Macroeconomic Factors

Liquidity or Credit Crunch

The MSME sector is facing a huge cash crunch as the primary lender in the Indian market — the banks — are going through a bad cycle and are struggling with huge NPAs (Figure 5) in their balance sheet. Along with their poor financial health, they are also facing heat from the government in terms of updated regulations which increases the compliance efforts and also makes the bankers responsible for bad loans. All of this together deters the public sector banks from lending to the MSMEs and hence the growth rate of lending to MSMEs decreased to 3.3% CAGR between March 2013 to March 2018. Not just this, close to 45% of the loan applications recommended by DLTFC in the fiscal year 2016–17, was rejected (Figure 7), which further strained the MSMEs to continue with their operations.

Due to difficulties in finding finance for the MSMEs, many of the existing MSMEs died during events like demonetization, launch of GST etc. Most of the existing MSME firms were working with limited capital and they couldn’t survive during such distressing periods and were eventually shut down. The same circumstances made it difficult to start new MSMEs.

Slowdown of Indian Economy

The Prime Minister of India Mr. Modi announced demonetization of currency notes of denomination of ₹500 and ₹1000, removing close to 86% of the money from circulation [23], putting a break on highly cash-driven MSME industries, which were crucial for the success of Make in India. The cash crunch resulted in a 2 percentage point dip in GDP which further affected the MSME sector which was in dire need of support.

As per an Indian daily, The Hindu, “ Disruptions caused by demonetization spills over into the third straight quarter amid slowdown in manufacturing activities “ [24]. This long wait for the revival of the economy was good enough to kill many if the small MSMEs which were already struggling due to cash crunch and the disrupted supply chain after demonetization.

Tax Reforms

As part of the tax reforms, India launched Goods and Services Tax (GST) on 1st of July 2017. However, GST is marred with multiple issues like:

Technical issues: Businesses are facing a lot of technical issues as it required the tax to be filed online and needs good internet connection. Some of the forms doesn’t allow amendments, apart from this issue like reversal of tax credit, which needs to be reversed manually in certain situations is a real pain point for small businesses.

Late refunds: Delay in refunds in the GST system is increasing in order catch fraudulent refund requests, but this has increased cash requirement of businesses, and is stressing the small businesses unnecessarily.

Legal Hurdles

There are multiple legal hurdles to do business in India, if we start with the legal system of India it’s probably one of the slowest and costliest in the world. A legal case can range from anywhere a year and a half to almost four years before the decision gets enforced in India (Figure 10) and might cost up to 40% of the claim amount depending on the city. All of its visible in the Ease of Doing Business ranking from The World Bank, where we rank 163rd out of 181 countries in the contracts enforcement.

Land Reforms

The Government of India needs to bring significant land reforms to make it easier for businesses to acquire and register land to establish their operations. India is one of the laggards when it comes to registering the property and it ranks 154 out of 181 countries which were evaluated by The World Bank in 2019.

In India even the constructions permits are difficult to get, and it takes close to 114 days to get various construction permits, compared to 69 days in Hong Kong. It’s not just about the days, India needs a greater number of documentation and touch points before the permit is granted.

Labor Laws

Labor laws in India is one of the biggest roadblocks for the growth of MSMEs and thereby the Make in India scheme of Government of India. The majority of these laws are archaic and are holding back the economic development of the country. India’s inflexible labor market was and is a roadblock in the growth of labor-intensive manufacturing sector [28], which Make in India is trying to target.

Various researches have shown that there’s a negative correlation between pro-worker labor laws on industrialization, economy, and employment. Moreover, many of the central and state labor laws are contradictory and are difficult to comply in today’s era[28].

Majority of these labor regulation becomes applicable when firms have more than 100 labors on their payroll; this becomes a huge deterrent for the firms to grow their operations and they stop growing beyond a certain point, which deprives them to leverage the economies of scale in the long term and creates sub-optimal economic output. The data from the Economic Survey of India, 2020 also suggests that having a pro-business labor laws encourages formation of MSME firms in the given state (Figure 12) [21].

Foreign Direct Investment

Foreign Direct Investment (FDI) is one of the major sources of funding for manufacturing sector, however, data suggests that FDI inflow in manufacturing sector for the period of 2000 to 2019 is only 34%, only around half of which goes into creating new businesses [29].

The biggest hurdle with FDI is that it’s contribution to manufacturing is small and even in that it facilitates very small amount of technology transfer if any. India must come up with updated FDI policy which facilitates more joint ventures and technology transfers.Moreover, growth rate in FDI has reduced significantly over the time and as per the available data Make in India doesn’t seems to have supported it.

Ease of Doing Business

Ease of Doing Business rank and score is released by World Bank each year to measure business conduciveness across 190 countries. In 2014, Indian government announced an ambitious target to be in top 50 rankings. To improve the rankings, central government as well as state governments took reform measures, especially around 10 measuring parameters surveyed by World Bank.

However, when one closely looks at the data, one realizes that the Ease of Doing Business survey is based on the data collected only from Mumbai and Delhi markets and therefore, is not the correct representation of the actual condition on the ground.

The bureaucracy is still corrupt, and the economy is chocking due to lack of credit availability while institutions meant to protect the interest of the economy is generally too late to act on symptoms showing signs of upcoming failure.

In the World Bank index of “Ease of Doing Business”, India secured 63rd rank and scored 71( China rank 31 and Vietnam 70) in 2020, a significant improvement from 142nd rank in 2014, before the launch of “Make in India” campaign [31].

From the segment-wise ranking depicted above we find that although India has improved almost on all parameters, Considerable improvements are seen in:

However, on a few other parameters there has been very little improvement:

Despite the government’s tall claims of easing the process, we see that starting a new business is still very difficult in India. Also, despite the digitization of land records in most states, registering property is a big concern. Moreover, despite having robust payment infra and digitization, paying taxes still seems to be troubling for businesses. Furthermore, there has been hardly any improvements in “enforcing contracts”. The government claims to set up a commercial court to settle disputes quickly, however, much improvement is still needed. States play a major role in some of the measured parameters and the Department for Promotion of Industry and Internal Trade (DPIIT) has launched Business Reforms Action Plan (BRAP) to assess the measures and their impacts taken by states [31].

Competitiveness Index

The World Economic Forum measures countries’ competitiveness performance according to 114 indicators that improves productivity parameters. It is a tool to help governments to boost productivity and general prosperity.

From the global competitiveness rank we see that, in fact there is a deterioration in India’s ranking. In latest ranking we find that much improvement is needed in Human Capital, Labor Market and Product market.

Start Up Ecosystem

Growth in start-ups is a silver lining for India. Currently, India has the third-largest ecosystem in the world and count is more than 50,000 (29,356 recognized by DPIIT). As per government data, private equity firms have invested more than $26 bn in Indian startups [35].

Startups are not coming only in usual hi-tech fields such as IT, AI, ML, Robotics but also in agriculture, logistics, defense component manufacturing etc. The government has opened many incubation centers across India and most of the sates have startup policy too. However, it seems from the government website report that growth in a startup is mostly funded and supported by the private sector dominated by MNCs.

With the Startup India policy, the Government of India has brought few policies for supporting startups, however, their efficacy and impact have not been assessed. These policies are:

Conclusion

Make in India was one of the flagship initiatives of the Government of India in 2014. The purpose and intent to bring this scheme were to increase the contribution of manufacturing to 25% in the Indian GDP, increase employment, and follow the policy of export-led growth adopted by many east-Asian economies. Another critical aim of this policy was to develop capability in high tech and reduce dependency on imports. The proposed plan of the Government of India was great but due to lackluster implementation on the ground, it couldn’t generate the desired results so far.

Make in India was marred by multiple issues on the ground like lack of policy coherence by multiple ministries of the Government of India, appreciation of rupee in real terms, trade wars between countries, protectionist measures by developed countries, affect of demonetization and GST implementation etc.

MSMEs can be the driver of growth of manufacturing in India, however, due to credit crunch and monetary policies and other prevalent issues they are not able to perform or sustain the required growth.

The government of India needs to have a coherent policy from all of its ministries and state governments and should ensure the availability of credit to MSMEs, disequilibrium exchange rates, and reduce the cost of doing business in India. Another key thing is to further improve on the Ease of Doing Business by reducing the required documentation and compliance requirements to start a new business in India. One of the main concerns of business is the taxation or GST and the late refunds, the Government of India should proactively intervene and solve these issues to the earliest. The last suggestion we would like to give is to form separate commercials courts to only deal with business cases to make the legal resolutions faster and cost-effective.

One of the biggest priorities should be to remove the inverted duty structure in tariffs on various goods. Encourage the clustering approach for MSMEs and come up with favorable rules to support them.

Government should try to become part of the global value chain of network products.

Bibliography

[1] “India — GDP — real growth rate — Historical Data Graphs per Year,” 07-Mar-2020. [Online]. Available: https://www.indexmundi.com/g/g.aspx?c=in&v=66. [Accessed: 08-Mar-2020].[2] S. Mehrotra, “‘Make in India’: The Components of a Manufacturing Strategy for India,” Ind. J. Labour Econ., Jan. 2020, doi: 10.1007/s41027–019–00201–9.[3] R. Rajan, “Make in India, Largely for India,” vol. 50, no. 3, p. 13, 2015.[4] “NEW INITIATIVES — Make In India,” 07-Mar-2020. [Online]. Available: http://www.makeinindia.com/policy/new-initiatives. [Accessed: 07-Mar-2020].[5] C. Market, “India Aiming To Reduce Logistics Cost To Less Than 10% Of GDP By 2022,” Business Standard India, 24-Aug-2018.[6] “Skill Development Sector — Achievement Report.” .[7] “India Labour Productivity Growth [1992–2020] [Data & Charts],” 07-Mar-2020. [Online]. Available: https://www.ceicdata.com/en/indicator/india/labour-productivity-growth. [Accessed: 07-Mar-2020].[8] “EASE OF DOING BUSINESS — Make In India,” 07-Mar-2020. [Online]. Available: http://www.makeinindia.com/eodb. [Accessed: 07-Mar-2020].[9] “Global Competitiveness Report 2019,” World Economic Forum, 07-Mar-2020. [Online]. Available: https://www.weforum.org/reports/how-to-end-a-decade-of-lost-productivity-growth/. [Accessed: 07-Mar-2020].[10] “Make In India Programme, All About The Manufacture in India Initiative.” [Online]. Available: https://www.ibef.org/economy/make-in-india. [Accessed: 08-Mar-2020].[11] “IIP data from https://www.ceicdata.com/en/indicator/india/industrial-production-index-growth."[12] “Manufacturing, value added (% of GDP) — India | Data,” 08-Mar-2020. [Online]. Available: https://data.worldbank.org/indicator/NV.IND.MANF.ZS?end=2018&locations=IN&start=2009. [Accessed: 08-Mar-2020].[13] “MSME share in GDP.” .[14] S. Morris, “Prof Sebastian Morris’s class discussion.” .[15] S. Mehrotra, “‘Make in India’: The Components of a Manufacturing Strategy for India,” Ind. J. Labour Econ., Jan. 2020, doi: 10.1007/s41027–019–00201–9.[16] S. Morris, “Prof Sebastian Morris’s class discussion.” .[17] P. K. Nanda, “Labour code bill introduced in Lok Sabha, likely to cheer industry,” Livemint, 28-Nov-2019. [Online]. Available: https://www.livemint.com/news/india/labour-code-on-industrial-relations-bill-introduced-in-parliament-11574951810922.html. [Accessed: 08-Mar-2020].[18] S. Morris, Constraints to export growth in the small firm sector by Sebastian Morris (Working Paper, №98–08–06/1467). Indian Institute of Management, 1998.[19] S. Morris, “Why Not Push for a 9 per Cent Growth Rate?,” Economic and Political Weekly, vol. 32, no. 20/21, pp. 1153–1166, 1997.[20] “Debt Distress 2.0: Total stressed assets now exceed gross NPA peaks of 2018 — The Economic Times.” [Online]. Available: https://economictimes.indiatimes.com/industry/banking/finance/debt-distress-2-0-total-stressed-assets-now-exceed-gross-npa-peaks-of-2018/articleshow/71236750.cms. [Accessed: 07-Mar-2020].[21] “Economic Survey.” [Online]. Available: https://www.indiabudget.gov.in/economicsurvey/. [Accessed: 07-Mar-2020].[22] “Applications Rejected by Banks against Applications Recommended by DLTFC under PMEGP for setting up of Enterprises from 2015–16 to 2018–19,” Open Government Data(OGD) Community. [Online]. Available: https://community.data.gov.in/applications-rejected-by-banks-against-applications-recommended-by-dltfc-under-pmegp-for-setting-up-of-enterprises-from-2015-16-to-2018-19/. [Accessed: 07-Mar-2020].[23] G. Chodorow-Reich, G. Gopinath, P. Mishra, and A. Narayanan, “Cash and the economy: Evidence from India’s demonetization,” 2019.[24] “GDP growth slips to 5.7% in April-June,” The Hindu, 31-Aug-2017.[25] “Business Regulations Across India,” World Bank. [Online]. Available: https://www.doingbusiness.org/en/reports/subnational-reports/india. [Accessed: 08-Mar-2020].[26] S. N. Sharma and S. Layak, “GST: The challenges before India’s largest indirect tax reform.”[27] World Bank, Doing Business 2020: Comparing Business Regulation in 190 Economies. Washington, DC: World Bank, 2020.[28] A. Karani and R. Panda, “‘Make in India’ Campaign: Labour Law Reform Strategy and Its Impact on Job Creation Opportunities in India,” Management and Labour Studies, vol. 43, no. 1–2, pp. 58–69, Feb. 2018, doi: 10.1177/0258042X17753177.[29] “Decoding Slowdown: FDI inflows trend shows all’s not well; growth drops to single digits.” [Online]. Available: https://www.businesstoday.in/current/economy-politics/foreign-direct-investment-fdi-falls-further-decoding-slowdown-more-capital-outflows-indian-economy/story/377419.html. [Accessed: 08-Mar-2020].[30] “Ease of Doing Business India Ranking: India moves up 14 spots to 63 on World Bank’s ease of doing business | India Business News — Times of India,” The Times of India. [Online]. Available: https://timesofindia.indiatimes.com/business/india-business/india-moves-up-14-spots-to-63-on-world-banks-ease-of-doing-business/articleshow/71731668.cms. [Accessed: 08-Mar-2020].[31] “EASE OF DOING BUSINESS — Make In India.” [Online]. Available: http://www.makeinindia.com/eodb. [Accessed: 07-Mar-2020].[32] “World Bank Country Profile.” 07-Mar-2020.[33] World Bank, Doing Business 2013: Smarter Regulations for Small and Medium-Size Enterprises. The World Bank, 2012.[34] “Global Competitiveness Report 2019,” World Economic Forum. [Online]. Available: https://www.weforum.org/reports/how-to-end-a-decade-of-lost-productivity-growth/. [Accessed: 07-Mar-2020].[35] “Indian Startup Ecosystem.” [Online]. Available: https://www.startupindia.gov.in/content/sih/en/international/go-to-market-guide/indian-startup-ecosystem.html. [Accessed: 08-Mar-2020].[36] “Startup India,” 08-Mar-2020. [Online]. Available: https://www.startupindia.gov.in/content/sih/en/home-page.html. [Accessed: 08-Mar-2020].[37] S. V. Kumar, “EXPLORATION AND MINING IN INDIA: TIME FOR A DEEPER LOOK,” p. 40.